7 secrets of loans, borrowings, and financing that new managers who want to do but do not have money should do (3)

Hello. It is a hori of the manager.

Following the previous round, I would like to share the seven secrets of loans, borrowings, and financing, part 3.

I told you that it is difficult to provide loans alone by the president (business operator) twice in the past.

In part 3, let's grasp how financial forms are going, as it is easy and good.

Whether you or your company can borrow money or not, in a word, whether you have social credibility or not, that's all.

In terms of the company, it is judged comprehensively how many years of business history, how much own funds are, what kind of business you are doing, and whether there are debts.

In that sense, when it comes to how to trust a company that has just established a company and does not have much self-funds, there are only the personality of the president and the career and professional skills as a company employee.

The president who has just established a company wants to talk about how great his business is and how successful it is, but it is just an ideal and aspiration, and you don't know if it will really happen.

I feel that those who are studying business diligently tend to do so more.

It doesn't mean it's bad, and no matter how confident you are in your business, you'd better think that's what financial institutions see at first.

In such a case, trust is more of a self-fund or career as a company employee written earlier than the development of business, so let's calculate that point when starting an independent business.

In addition, as a reason for my promotion of side jobs, the creditworthiness of "I am still working" is difficult to replace anything. Even if the business you are trying to do fails, having regular income is only a positive factor for financial institutions. If you fail, you will be seen as a source of repayment.

Some people concerned about side jobs, who want to be behind them, or that they may not be able to convey their seriousness to the business to the person in charge of financial institutions.

Financial institutions do not judge trust by invisible things such as seriousness and motivation.

Judge trust only with something in the form of whether you can repay properly.

At first, I was a company that I didn't know anything about, but while working for JETRO, I realize that the creditworthiness of doing my own trade business was high.

To be precise, JETRO was not in the trade sector, but from the outside, jetro = trade, so it was somehow possible.

Since this article is written on the premise of raising funds, the story is pro-financing, but of course it is okay to raise funds or not.

It is the president's judgment.

However, it is necessary to have such a recognition at a minimum how the company is viewed by society.

Trust is not aspiration, a dream, or a social contribution.

Of course, in the end, we need that vision.

When you're just starting out, know how your company evaluates and judges, especially the first financial institutions that help your company.

On top of that, visions and the like will come into board.

Contents

Let's understand how money flows

Policy Finance Corporation

The Policy Finance Corporation judges the loan by the credit whether the president is suitable in various meanings for the time being, and whether the state of the company is remarkably wrong even if the business has just started.

From that point of mind, I think it would be good to hit the gate once in the early days of the company's founding.

Of course, the Policy Corporation is also working on larger projects, but it also takes care of the founding company as a gateway to going to the gate.

Shinkin Bank (Local Bank)

In the previous article, I said that we should use local shinkin banks because the government has created a system to secure trust in small and medium-sized enterprises.

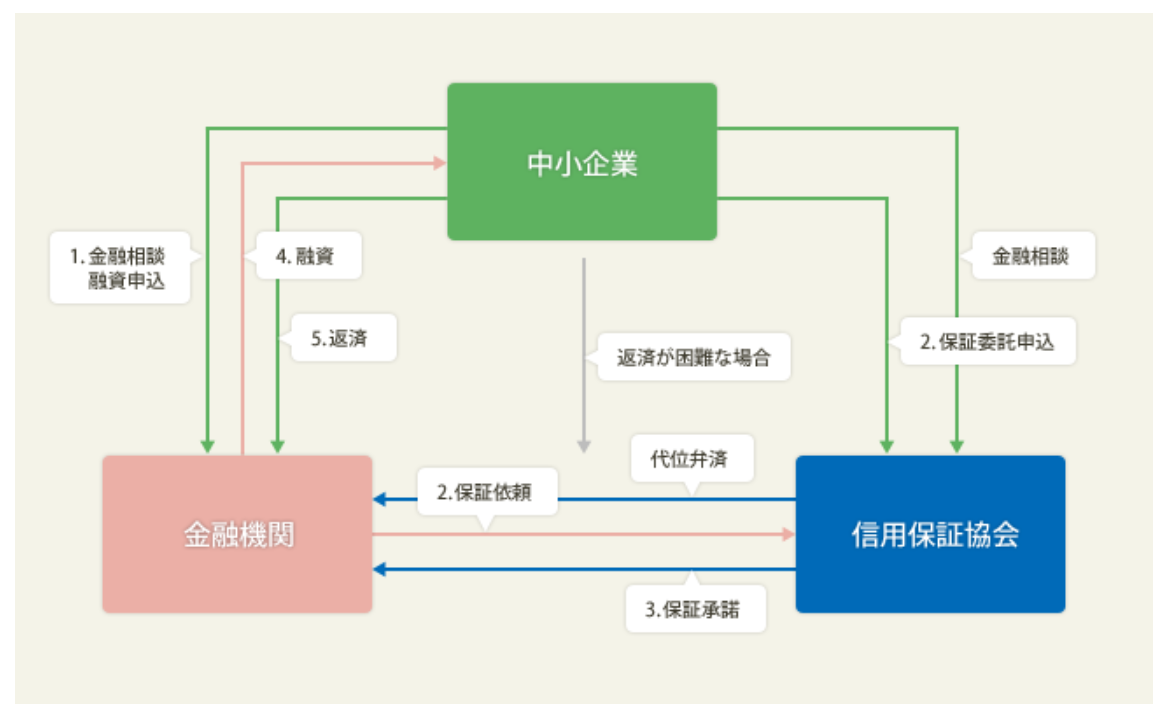

That is the Credit Guarantee Association.

As quoted in the previous article, when small and medium-sized enterprises borrow from financial institutions such as local shinkin banks, there is a system that the Credit Guarantee Association guarantees by paying a certain guarantee fee.

This credit guarantee association guarantees, so financial institutions lend funds to small and medium-sized enterprises.

Conversely, it is a diagram that small and medium-sized enterprises will not be able to obtain trust from financial institutions unless this is done.

In other words, it is regrettable that megabanks deal only with major companies, because it becomes a direct transaction without such credit guarantee associations, and creditworthiness on a single company is required, but it is not possible to deal with megabanks as a small and medium-sized enterprise.

By the way, this credit guarantee association seems to have propper staff, but there seems to be a local financial institution.

From the perspective of those who are far from this world, there is no smell of concession, but it is not related to my business, so I think the important thing is how to know the structure of such a society and use it.

chamber of commerce

We recommend that you join the Chamber of Commerce in the next section, but this chamber may also act as a credit guarantee association.

For example, the Policy Finance Corporation has a system in which small business merchants and industrial workers who receive management guidance such as chambers of commerce and industry and chambers of commerce and industry lend funds necessary for management improvement.

In particular, there is a system that can be used by collateral and non-guarantor named Marukei Loan (small business management improvement fund).

The person in charge of the chamber of commerce and industry passes the approval in the commerce and industry conference, consults the Policy Finance Corporation, and the loan is approved.

We have implemented this Marukei, but I think it is very large that the representative guarantee will come off. In most cases, in any loan, you borrow from a corporation, and the representative director becomes a joint guarantor.

In other words, if the company is unable to repay the debt, the representative will pay off the loan by the individual, but this Marukei loan will not be the representative guarantee.

It is a loan that is so much when the company can not pay, so it is very easy. Of course, you should not think about such a thing, but I think it is not a loss to remember that it is such a system for the time being.

In addition, this is a measure of the Yokohama Chamber of Commerce and Industry, but there is a "cooperative loan with 11 financial institutions" in cooperation with local financial institutions, and if recommended by the Yokohama Chamber of Commerce and Industry, you can receive loans from partner financial institutions with the following contents. Preferential interest rates, preferential treatment in terms of maintenance (without third party or guarantee association guarantee), preferential treatment in terms of speed.

In addition, each chamber has various financing systems, so be sure to check the website of the nearest chamber of commerce.

Join the Chamber of Commerce

In the preceding paragraph, we introduced various loan systems via the Chamber of Commerce and Industry, but in order to utilize these systems, you must first be a member of the Chamber of Commerce and Industry.

Basically, the Chamber of Commerce and Industry exists at the municipal level of each prefecture, so it is ok to be a chamber of commerce closest to the company location, or you can join across borders in a large area.

However, in the case of cross-border enrollment, there may be restrictions on the use of the system, so please check in advance.

However, the system as in the previous section does not apply to companies that have just joined.

A minimum membership record of 6 months or more is required. It may vary depending on the region, so please check in advance.

However, if you are a waste to pay the annual fee without doing anything, there is a group mutual aid insurance, etc., so if you join there, you can get the original by that alone, so please use such a system as well.

There is no option not to join the Chamber of Commerce with a small business. Let's definitely join.

Please refer to this article as well.

Stop Suddenly Independent! First of all, let's draw the growth curve of the business by the side job! 7 Be sure to enter the local chamber of commerce and industry

Let's make active use of government loan measures.

In a previous article on coronavirus (4, government-supported loans have started to move amid a lot of damage among Japanese companies), the Ministry of Economy, Trade and Industry has expanded the safety net No. 4 guarantee of "measures against small and medium-sized enterprises related to the new coronavirus infection", and the Policy Finance Corporation's "Special Loan for New Coronavirus Infections" I wrote about.

In addition to this article, the former safety net No. 4 guarantee is basically loaned by local financial institutions, etc., and the system that the guarantee association guarantees remains the same.

However, it is a system that the government takes over the place where the small and medium-sized enterprise of the borrower pays the guarantee fee to the guarantee association.

In addition, it is usually difficult to receive additional loans from financial institutions that already owe loans, but since the government is requesting that they respond separately from ordinary loans, it is a mechanism that the loan passes relatively easily.

With regard to the latter policy finance corporation system, this is a system in which the public corporation provides loans separately from the loans already implemented to companies whose sales have been declining due to the spread of the coronavirus infection with government funds.

By the time this article catches the eye, I think these coronavirus loans are over, but I hope this system will also be an opportunity to learn that it is actually moving on a certain system.

Bonus: After all, proper business assembly is important

This time, the main story to borrow may have been the backward part.

In addition, while knowing how to borrow will allow you to do business positively, it is often said that you should be careful not to rely on it alone.

I think so, too.

After all, I think that the original premise of business is to deal with products and services that will grow in the future. And if you are doing business positively like that, there will always be a time when you need more funds than cash and deposits.

Instead of panicking at that time, I hope you will start preparing for funding and securing funds in advance little by little.

If you can not find positive products in the first place, please refer to the following article.

Certification businesses such as PSE, PSC, radio law, etc. are effective for those who want to receive loans such as the Japan Finance Corporation!