7 secrets of loans, borrowings, and financing that new managers who want to do but do not have money should do (2)

Hello. It is a hori of the manager.

Following on from the previous article, I would like to share with you the seven secrets of loans, borrowings, and financing, part 2.

Last time, I told him that fundraising is a job that can only be done by the president, so we should create a partner who can consult and discuss from normal times, whether or not a loan is necessary right now.

This is also our experience story, but at first I didn't know anything and went around several tax accountant offices alone, and I went to the support center of my local government.

I had a strong desire to get a loan because I created a company, but I wanted to know what kind of mechanism this loan is in the first place.

In conclusion, we should utilize consultants who are professionally fundraising.

What I felt when I talked to multiple tax accountants and small and medium-sized business diagnostics,

There is a similarity to the world of certification, but I felt that there are many people who know the system but do not have the know-how to implement it concretely.

Of course, this is my experience, so I can't say everyone at all, but it's probably a trend. If you have any tax accountants who have any objections, please contact us.

To be honest, the ability in financing is too different between a professional engineer and a fundraising consultant. But the success reward is almost the same.

This time, I would like to focus on that point.

Contents

Tax accountants and small and medium-sized enterprise diagnostics were not able to raise funds straight

As A rule of thumb that we worked with several times,

The decisive difference between a tax accountant, a small and medium-sized enterprise diagnostician, and a fundraising consultant is

With the know-how you have, above all, absolutely through the loan! It is consciousness.

In short, the person of the professional occupation has my specialty separately, so it is a sense that the loan is a bonus. It is an experience story to the last.

Unfortunately, however, for managers, they do not understand that their specialty is a bonus and that lending is their favorite.

Although there is a major premise that companies do not turn without cash, the awareness that professional workers do their own specialty is inevitably preceded.

Of course, it is also necessary to have them specialize as one of the roles of company management, but at least it is a serious hindrance in the field of financing and financing.

If you write it with your own experience, as I mentioned in "Making a trial calculation table" in the previous article, a trial calculation is absolutely necessary in the loan interview.

But there was a tax accountant who made me go to the interview with a trial calculation table that did not have such a thing and had no idea.

In some of the interviews with the Policy Finance Corporation, we sometimes used our office, and while I said that I could talk normally with people in the Policy Corporation, I could not communicate at all when I actually met with people from the Policy Corporation.

Also, the story of other tax accountant A.

The Policy Finance Corporation has many loan names. Among them, we have drawn out what can be passed through the loan at the time of establishment under another pretext, and even so, it has failed considerably and a little loan has been made, but it is a bitter experience that the next loan was quite difficult.

When considering the next loan, why do you withdraw such a loan with mr. B, a new loan consultant who requested it, and the person in charge of the commerce and industry conference company described later? and had tilted his head.

Mr. B analyzed that it would be good if the loan could be withdrawn only then, and that the company could not calculate how it would manage in the future and when and how funds would be needed.

As an aside, after a little after the first loan, the loan was still being repaid, but the company's cash was inevitably insufficient, and it is okay to make an additional loan to the tax accountant A because it is okay? When I heard that, it was difficult. It is likely to write a trial balance, and it will still take half a year. If that's the case, you might want to borrow it from an acquaintance. And the answer.

I was quite shocked by the words that were so far from the sense of the people involved.

To be honest, I thought that I could not use this guy, so I asked my master to introduce mr. B, a fundraising consultation. I will describe the specific details later, but to conclude, they raised 5 million yen in the first two months.

A tax accountant who is 500,000 yen tough in one or half a year, and a consultant who raised 5 million yen in two months. Of course, the state of the company is the same.

Thanks to that, we were able to revive and it was a catalyst for our subsequent growth.

Also, as a later story, Mr. A heard from my teacher, who is a mutual acquaintance, that I had raised 5 million yen, and said, "Eh!? It seems to have reacted quite a surprise.

When I heard that story, I felt that Mr. A did not take care of it, but that he did not have the know-how to pass the loan and that he was really speaking out.

Mr. A is also a person who has been in the world of tax accountants for more than 20 years, so he is not an amateur of money at all. However, I feel that there was a difference in ability in lending.

I will also write about an episode with a small and medium-sized business diagnostician.

When I went to the small and medium-sized enterprise support center of the local government, I remember being criticized for the documents I made myself.

It is only appearance such as the character is small or strength is attached.

What I felt later on when I actually executed the loan was that it was basically useless work.

In addition, I have never made a plan, so I do not know how to do it, and as soon as I saw the sales plan that I tried hard once, I was laughed at with my nose and said, "There can be no such plan." I will never forget what was said.

In hindsight, it is certainly the case, but I thought that the professional business employed by a special corporation was really easy just by turning back, even though it was supposed to be work to guide it somehow.

As with Mr. A, a tax accountant, these people can say this and that to people who have completed some form, but I do not think that there is any know-how to instruct and raise people who are really starting from 0. Of course, there may be some people.

On the other hand, people like Consultant B may be funded by negative people if they need 0 or not. That's the know-how, isn't it?

In particular, small and medium-sized enterprise diagnosticians read financial statements, explain the system, and explain the necessary documents, but only those who cannot actually write a trial calculation sheet and withdraw the loan.

I've seen people like that.

If you can give advice to new managers, I don't think you need to be too grateful to say that you are a small and medium-sized business diagnostician.

Rather. What kind of benefits will these people bring to their company?

It will be necessary to judge calmly.

Of course, there is no doubt that each professional has a role, but information and work that the professional industry has monopolized so far can be obtained and implemented by parties concerned due to the development of the Internet.

On the other hand, the era of rapid change and the company that was about 10 years ago quickly became 0, and on the other hand, the number of people who start a business and start a side job boom is increasing rapidly.

In other words, in today's world, there is a greater need to make the company bigger from 0, and there is a growing need to choose people who can work together from 0 as a partner for you to grow your company.

In that sense, it is necessary to consider raising funds even from 0, so I recommend that you have a specialist consultant on your side rather than the professional business.

Take advantage of a fundraising consultant

I've written only stories about lifting a fundraising consultant, but this is my impression of actually working with him.

As a result, it is assumed that the loan will be withdrawn, but there is a part to be suffered with the contents of the previous, but I will summarize the benefits of procurement consultants easily.

However, this may not be the case because my person in charge was, but I think that the following is probably a positive strategy for fundraising. Therefore, it may be good to compare it with the work contents of the fundraising consultant who is thinking about using it in the future.

Will you spare me some time to raise money?

As a matter of course, it takes a reasonable amount of time to raise funds.

My consultant, Mr. B, sometimes went to two or three financial institutions a day, such as banks.

However, it is not that you go around many times and bow to various places and ask for loans, but you are going around the necessary steps to get a loan.

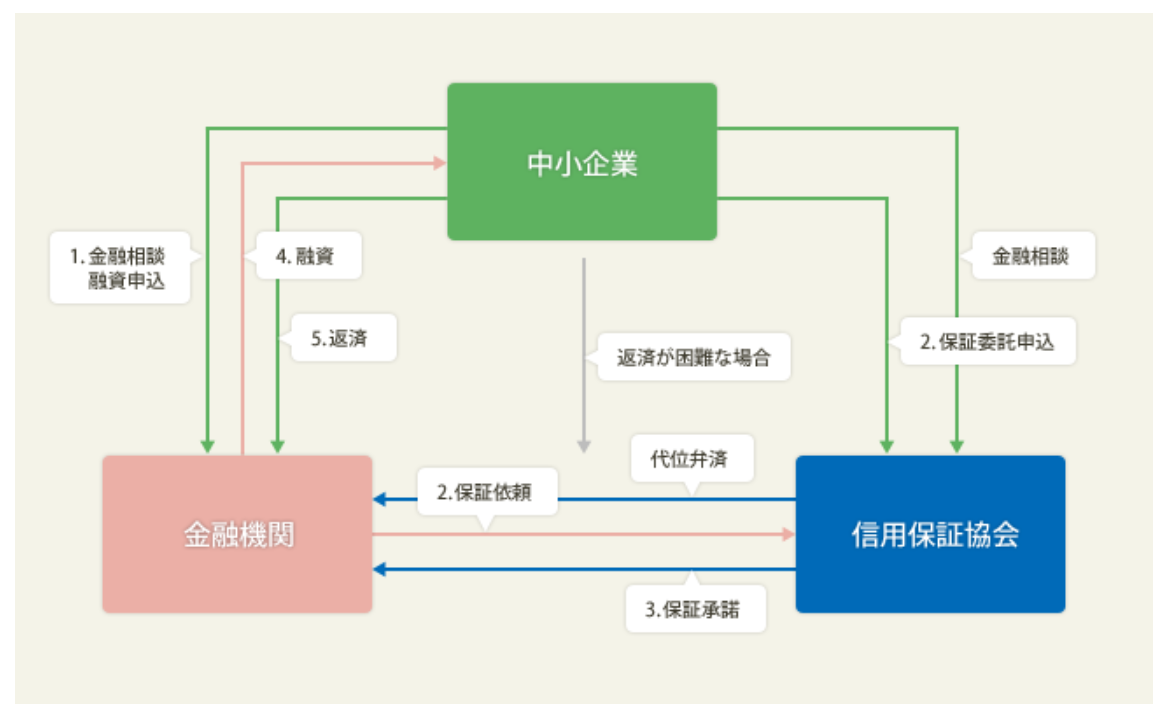

For example, there is a trend of going to a megabank where you have an account, asking for a loan and refusing (calculated), going to a local credit guarantee association to introduce you to a local shinkin bank.

I will not explain the process in this order, but there are social mechanisms that you can not know at all if you are only doing business.

However, even if you know this trend, it is difficult for the president to talk to the person in charge of each financial institution alone, so it is ultimately more efficient to have an expert come.

However, it takes time to do so, so I think it is difficult to secure time in the first place unless you are an expert who goes out with such things.

Why did I go to the Credit Guarantee Association and go to the Shinkin Bank?

Can prepare documents (such as trial calculation sheets) that are easy for financial institution personnel to pass approvals

Many people may have been misunderstood, but the person in charge of financial institutions basically wants to make a loan.

When influenced by dramas, financial institutions have the impression that it is a job to refuse, but basically the bank's job is a loan, so I want to make a loan.

However, it seems that there are many patterns that small and medium-sized companies and individuals cannot write approval documents for loans to be passed within the organization because the level of application documents is insufficient, and loans do not pass.

Of course, it is out of the question that the management state does not get caught in chopsticks or sticks before the contents of the documents, but the case is left behind, in short, it is a fundraising consultant that the bank staff will summarize the contents of the application documents so that it is easy to write approvals It is.

There are many procurement consultants who come from banks, and I think it is obvious that we know how to write application documents from the standpoint of writing approvals so far, and we know what kind of approvals will pass within the bank.

Just in case, what I want to say here is not to fill up the document contents with mouth hatchote hatcho to make it easier to pass documents, but to put the business contents together and into future development, such as which part is allowed to stand.

This is a big point different from tax accountants, etc., and there are many patterns in which tax accountants leave university and work at a tax accountant office as it is and take the tax accountant examination, and obs such as tax office and national tax agency pass the examination and work.

Even for work around money of the same management, the area in charge varies greatly depending on the business content. I think it is necessary for managers to understand such things.

Will you increase your relationships with financial institutions?

Even if you receive a loan from a financial institution, it is basically difficult to lend additional loans once you borrow them, unless there is much to do until the repayment is completed.

However, if you are managing, you may inevitably need additional loans, even if it is a premise that it is a positive debt.

In addition, there may be a need for a bank that can rush in immediately when it comes to emergency (although it is desirable not to do so).

In doing so, I think it is necessary to create about three or four relationships with banks and financial institutions and turn them around in peacetime.

We also have relationships with local shinkin banks, policy finance corporations, and Glitterboshi Bank, but in the first place, I didn't know what kind of financial institution I would meet and go out with.

There are also consultants with a wealth of knowledge about financial institutions.

I've been praising the fundraising consultant a great time.

Of course, their presence is essential for small and medium-sized enterprises, but one thing to note is that the skills of consultants are enormous and they know how to persuade financial institutions, so it is possible to borrow money easily.

They are also businesses, so sometimes they want their clients to borrow money and ask them to raise funds that they don't need. Although it is that there is a case to the last.

Borrowing while borrowing is also a management strategy, but ultimately it is the company and president who repays it, so be sure to judge yourself whether it is a loan that is really necessary.

As the story has become longer, I will continue (3) next time.